Volatility is inherent in the commodities market. In recent years, the world has faced the effects of the COVID-19 pandemic, coupled with the developments

Volatility is inherent in the commodities market. In recent years, the world has faced the effects of the COVID-19 pandemic, coupled with the developments in the Ukraine war. Additionally, climatic phenomena like La Niña have brought negative consequences to various regions.

These events bring about changes not only to production chains but also to the daily lives of the population. Production and consumption dynamics are altered and often result in sharp price fluctuations for food, fuels, and agricultural inputs.

How is all of this interconnected with volatility in the commodities market and the importance of risk management? That’s what you will discover in this content.

Volatility is a variable that allows for the analysis of the frequency and intensity of price fluctuations of a certain asset over time. In the case of commodities, whose prices are mainly determined by international supply and demand, volatility highlights the degree of sensitivity of the market to factors that can trigger changes in product values.

In practice, extremely volatile commodities can experience significant price variations in a single day. Thus, volatility serves as an indicator for traders to have prior knowledge of possible price scenarios for the commodity.

To understand how volatility occurs in practice, consider a Brazilian company that relies on Arabica coffee. On the first day, a 60kg sack of coffee is quoted at R$ 800 on the reference physical market exchange. The next day, the same quantity costs R$ 750. In other words, coffee underwent a significant price fluctuation in a short period.

Volatility is subject to a series of factors that can trigger price variations. Changes in supply and demand are the main drivers of commodities’ volatility. Any event that affects production and/or consumption can influence supply and demand, such as:

Weather conditions play a critical role in the commodities market. Droughts, floods, and frosts can modify crop production and, consequently, food prices.

For example, La Niña causes droughts and floods, varying according to the affected area. In Latin America, this natural phenomenon ended in March 2023 after a 3-year duration. Characterized by the cooling of Pacific waters, its local effects were intense on crops like wheat in Argentina.

The 2022/2023 Argentine wheat harvest was the worst in recent years, marked by a historic drought resulting in 10 million fewer tons produced than the previous season. With reduced local supply and unchanged demand, prices rise for consumers, and imports also become more expensive.

Geopolitical tensions, election years, armed conflicts, or changes in trade policies of commodity-producing or exporting countries can disrupt supply chains and increase price volatility.

This is evident in the Ukraine war. Global initiatives were put in place to mitigate the negative consequences on the circulation of basic products such as grains, which the countries involved in the conflict are important producers and exporters of.

Among these initiatives was the agreement for the transit of Ukrainian grains through the Black Sea, signed by the United Nations and Turkey in July 2022, allowing Ukrainian grain exports. However, the agreement was terminated this year, creating even more uncertainties.

Changes in government economic policies often have repercussions throughout the commodities market.

To understand this, we suggest reading our article on the Chinese real estate sector issue. China’s market is not sufficiently heated with current fiscal and monetary incentives, leading to a decrease in real estate investments and significantly impacting the need for oil imports.

Inventory levels and storage capacity play a role in volatility. Low inventory levels make the market more sensitive to supply disruptions. Excess products tend to increase the need for storage and reduce selling prices for producers if demand does not keep pace with the same growth.

This is currently happening in Brazil: the country produces more than it can effectively store. With the prospect of a record grain harvest for 23/24, this issue is at risk of strengthening. We suggest reading this article to learn more about the Brazilian storage issue.

Health crises, such as the COVID-19 pandemic, create uncertainties and lead to sharp movements in commodity prices.

This was an event that, like the Ukraine war, deserves significant attention because it clearly shows the impacts of volatility on the commodities market.

Below, we explain all the details.

The COVID-19 pandemic and the conflict between Russia and Ukraine caused prices to rise in the commodities market and contributed to global inflation. Many countries experienced difficulties in dealing with the health crisis, and its consequences were exacerbated by the ongoing war.

During the COVID-19 pandemic, many companies halted the production of commodities because people couldn’t go to factories to work. There were disruptions in logistics chains and competition to secure basic products, with concerns about reduced supply worldwide due to social distancing measures.

Commodity prices were impacted, and the effects of the pandemic are still felt today. Central banks in various nations moved to stimulate the economy by reducing interest rates. However, the increased availability of money did not accompany a proportional expansion of supply, a scenario that kept prices of several commodities high.

A situation of higher price inflation emerged worldwide, with authorities backtracking on their measures and starting to raise interest rates, creating the perfect scenario for an economic recession. Consumers felt this in their wallets, paying more for food and fuel.

Russia’s invasion of Ukrainian territory intensified existing concerns about the supply of food, energy, and inputs like fertilizers. Russia is a significant producer and exporter of natural gas and oil, while Ukraine has a strong presence in international grain trade. The potential reduction in supply further accelerated the value of commodities.

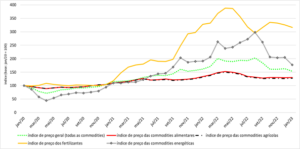

International commodity prices, as calculated by the International Monetary Fund (IMF), showed an increase in the early months of the conflict, especially in the prices of energy commodities and fertilizers (reaching extreme levels in April and May 2022).

In the graph below, you can observe the commodity price index from Jan/20 to Jan/23.

Fonte: FMI | Cepea Esalq/USP

Volatility cannot be eliminated since events are dynamic and sometimes unpredictable. However, there are tools that assist in managing risks in the commodities market.

To do this, it is essential to monitor trends and stay informed about all aspects that affect commodity prices. hEDGEpoint combines sophisticated hedge products with data analysis, which helps in making more informed decisions.

With professionals operating globally, we provide insights and contribute to generating more protection. Contact us to learn more!

Rua Funchal, 418, 18º andar - Vila Olímpia São Paulo, SP, Brasil

Contato

(00) 99999-8888 example@mail.com

Section

Home

O que Fazemos

Mercado

Quem Somos

HUB

Blog

Esta página foi preparada pela Hedgepoint Schweiz AG e suas afiliadas (“Hedgepoint”) exclusivamente para fins informativos e instrutivos, sem o objetivo de estabelecer obrigações ou compromissos com terceiros, nem de promover uma oferta ou solicitação de oferta de venda ou compra de quaisquer valores mobiliários, commodity interests ou produtos de investimento.

A Hedgepoint e suas associadas renunciam expressamente a qualquer uso das informações contidas neste documento que direta ou indiretamente resulte em danos ou prejuízos de qualquer natureza. As informações são obtidas de fontes que acreditamos serem confiáveis, mas não garantimos a atualidade ou precisão dessas informações.

O trading de commodity interests, como futuros, opções e swaps, envolve um risco substancial de perda e pode não ser adequado para todos os investidores. Você deve considerar cuidadosamente se esse tipo de negociação é adequado para você, levando em conta sua situação financeira. O desempenho passado não é necessariamente indicativo de resultados futuros. Os clientes devem confiar em seu próprio julgamento independente e/ou consultores antes de realizar qualquer transação.

A Hedgepoint não fornece consultoria jurídica, tributária ou contábil, sendo de sua responsabilidade buscar essas orientações separadamente.

A Hedgepoint Schweiz AG está organizada, constituída e existente sob as leis da Suíça, é afiliada à ARIF, a Associação Romande des Intermédiaires Financiers, que é uma Organização de Autorregulação autorizada pela FINMA. A Hedgepoint Commodities LLC está organizada, constituída e existente sob as leis dos Estados Unidos, sendo autorizada e regulada pela Commodity Futures Trading Commission (CFTC) e é membro da National Futures Association (NFA), atuando como Introducing Broker e Commodity Trading Advisor. A Hedgepoint Global Markets Limited é regulada pela Dubai Financial Services Authority. O conteúdo é direcionado a Clientes Profissionais e não a Clientes de Varejo. A Hedgepoint Global Markets PTE. Ltd está organizada, constituída e existente sob as leis de Singapura, isenta de obter uma licença de serviços financeiros conforme o Segundo Anexo do Securities and Futures (Licensing and Conduct of Business) Act, pela Monetary Authority of Singapore (MAS). A Hedgepoint Global Markets DTVM Ltda. é autorizada e regulada no Brasil pelo Banco Central do Brasil (BCB) e pela Comissão de Valores Mobiliários (CVM). A Hedgepoint Serviços Ltda. está organizada, constituída e existente sob as leis do Brasil. A Hedgepoint Global Markets S.A. está organizada, constituída e existente sob as leis do Uruguai.

Em caso de dúvidas não resolvidas no primeiro contato com o atendimento ao cliente (client.services@hedgepointglobal.com), entre em contato com o canal de ouvidoria interna (ombudsman@hedgepointglobal.com – global ou ouvidoria@hedgepointglobal.com – apenas Brasil) ou ligue para 0800-8788408 (apenas Brasil).

Integridade, ética e transparência são valores que guiam nossa cultura. Para fortalecer ainda mais nossas práticas, a Hedgepoint possui um canal de denúncias para colaboradores e terceiros via e-mail ethicline@hedgepointglobal.com ou pelo formulário Ethic Line – Hedgepoint Global Markets.

Nota de segurança: Todos os contatos com clientes e parceiros são realizados exclusivamente por meio do nosso domínio @hedgepointglobal.com. Não aceite informações, boletos, extratos ou solicitações de outros domínios e preste atenção especial a variações em letras ou grafias, pois podem indicar uma situação fraudulenta.

“Hedgepoint” e o logotipo “Hedgepoint” são marcas de uso exclusivo da Hedgepoint e/ou de suas afiliadas. O uso ou reprodução é proibido, a menos que expressamente autorizado pela HedgePoint.

Além disso, o uso de outras marcas neste documento foi autorizado apenas para fins de identificação. Isso, portanto, não implica quaisquer direitos da HedgePoint sobre essas marcas ou implica endosso, associação ou aprovação pelos proprietários dessas marcas com a Hedgepoint ou suas afiliadas.

aA Hedgepoint Global Markets é correspondente cambial do Ebury Banco de Câmbio, de acordo com a resolução CMN Nº 4.935, DE 29 DE JULHO DE 2021, Artigo 14 do Banco Central do Brasil (BACEN).

Para mais informações sobre nosso parceiro, serviços disponíveis, atendimento e ouvidoria, acesse o link a seguir: https://br.ebury.com/