At the outset of this year, there’s a heightened global interest in understanding the prospects of agricultural and energy commodities. Therefore, it is es

At the outset of this year, there’s a heightened global interest in understanding the prospects of agricultural and energy commodities. Therefore, it is essential to monitor the dynamics that could affect the sector. These include factors related to macroeconomics and geopolitics, as they present risks of causing volatility in the commodities market at local and global levels.

In this regard, hEDGEpoint‘s market intelligence team analyzed some relevant points for the commodities market in 2024, which were presented in the Outlook 2024 Webinar.

Read on, learn more about the subject and find out how to watch the event in full!

Below, you’ll find the main events that our professionals pointed out for the agribusiness sector to follow closely this year.

In the United States, the forecast points to prices converging toward the stipulated target after a costly disinflationary process. The restrictive scenario has not resulted in a recession, which will allow the Federal Reserve to start cutting interest rates this year.

Despite the elections, the US market’s historical resistance to political volatility may continue. However, interest rate cuts in the US may have a limited impact on US government bond yields. This is given the high public deficit and global geopolitical risks.

In the case of Europe, the ability to control inflation without a major impact on economic activity stands out. In addition, there is the ECB’s likely more hawkish stance (compared to the Fed) throughout 2024.

In Brazil, the economy surprised positively in 2023, with an exceptional performance in the trade balance. However, fiscal balance is expected to remain a challenge in 2024.

Meanwhile, in China, the relative weakness of economic activity and persistent deflationary pressures deserve attention. The country is also suffering from currency devaluation due to high-interest rates in the main global economies.

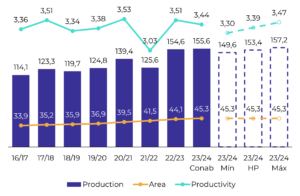

Soy is the main commodity in Brazilian agriculture. Brazil’s crop is expected to be smaller than initially forecast: the latest estimate from hEDGEpoint points to production of 154 million tons. At the beginning of the season, projections indicated more than 160 million tons.

Brazil Soybeans – Production (M ton)

Source: hEDGEpoint, Conab

On the international stage, the following factors make up the outlook for the soybean market in 2024:

The weather will be another key factor for soy producers in Brazil. It could therefore affect supply and demand in the country.

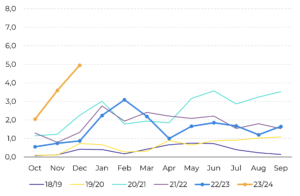

Like soybeans, corn has more comfortable global balances. It is essential to monitor Chinese demand for the commodity, which is falling in the 2023/24 harvest.

Maize China – Imports (M ton)

Source: Alfândega da China

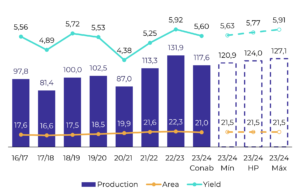

Due to adverse weather conditions, Brazil is expected to produce 117 million tons in the current cycle. This figure contradicts initial expectations, which pointed to 133 million tons.

Maize Brazil – Production (M ton)

Source: hEDGEpoint, Conab

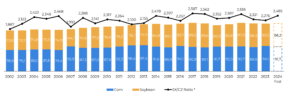

In the United States, the cereal has gained in area to the detriment of soybeans in recent years. However, planting intentions for the new North American crop are still uncertain and should be released soon. We need to keep an eye on this scenario, as the country’s competitiveness is likely to affect Brazilian prices on the foreign market.

Corn and Soybean Planted Area in the USA vs Soybean Ratio November/May December (M ac)

Source: USDA, hEDGEpoint

The world wheat stock/use ratio is the tightest it has been since 13/14. Practically all the main producing countries had smaller harvests compared to the previous year.

Russia‘s significant supply and the scenario of high interest rates are influencing a downward trend in the wheat market, which could persist into 2024. A large Russian winter crop is expected, with total production exceeding 90 million tons.

While Ukraine is forecasting a harvest of just over 20 million tons, in the United States, the risk of winterkill could impact the harvest, but conditions remain generally favorable.

Therefore, the Brazilian wheat market must follow global production developments, paying attention to the local and world climate. If the weather is favorable for the development of the crops, we should see a continuation of the downward trend in prices. However, adverse weather could lead to a change in the current trend.

World wheat closing stocks and stock/use (M mt)

Source: USDA

Currently, the global sugar market is in a delicate balance. Therefore, any changes in supply or demand can send prices skyrocketing.

Considering the drier weather in the coming months, Brazil’s Center South is expected to crush most of its available sugarcane. Record sugar production is expected: 42.4 million tons. Of this figure, 33.5 million tons should be exported.

In Brazil, the expected good production may be able to resolve the deficit in trade flows on its own and maintain the bearish force. If the weather continues to be favorable, we could see the same trading range for a while.

The Northern Hemisphere has seen a drop in production, with India out of the market. Thailand is once again experiencing lower availability due to adverse weather conditions. From the third quarter of the year, the emergence of La Niña deserves attention, as it could be crucial for recovery in the region.

In the coffee market, the potential reduction in Brazilian production of both arabica and conilon could push prices up. In addition, the conflict in the Red Sea is delaying shipments of the commodity.

Stocks are also historically low, with a deficit of robusta coffee, which strengthens the upward trend in prices. Vietnam, the main producing country, had lower production due to a reduction in area and irregular weather.

However, demand has increased over the same period. In the current context, Vietnam can supply the smallest amount of robusta to meet market demand in more than 16 years.

As possible low points for coffee prices, there are concerns about the 25/26 harvest due to the possible formation of La Niña at the beginning of the second semester.

Knowledge of the outlook for the energy market is extremely important for the agribusiness sector, as agriculture depends on energy resources. Understanding the trends in this market allows agribusiness professionals to make better-informed decisions.

In this sense, the first point to highlight is the fact that energy production is growing, but demand is not keeping pace. Non-OPEC+ countries are increasingly contributing to the increase in energy supply. There are therefore reasonable downside risks for the future.

Another relevant aspect concerns China, which is expected to drive demand for oil in 2024. However, the lower economic growth of the Chinese nation is expected to limit this expansion, as well as investment in non-fossil fuels.

The conflict between Israel and Hamas has introduced significant volatility into the market, with more ships avoiding the Red Sea route, which has fueled bullish sentiment, especially for the European energy market . Brazil needs to monitor the repercussions closely.

World balance of crude oil and liquid fuels (million bpd)

Soure: EIA

Although the oil market faces challenges, OPEC+ must continue to be an active agent in defending the stabilization of prices.

As you can see, numerous factors could cause volatility in Brazilian agricultural production in 2024. The commodities market requires continuous and in-depth analysis so that the entire chain can predict trends and protect itself from risks.

It makes all the difference to have the hEDGEpoint HUB. On our educational platform, you can check out the full analysis of hEDGEpoint‘s market intelligence team.

Sign up to the hEDGEpoint HUB now and watch our Outlook 2024 Webinar for free. You also get 30 days free on our platform. Get exclusive insights and stay one step ahead.

Visit us and find out how we can help your business!

Rua Funchal, 418, 18º andar - Vila Olímpia São Paulo, SP, Brasil

Contato

(00) 99999-8888 example@mail.com

Section

Home

O que Fazemos

Mercado

Quem Somos

HUB

Blog

Esta página foi preparada pela Hedgepoint Schweiz AG e suas afiliadas (“Hedgepoint”) exclusivamente para fins informativos e instrutivos, sem o objetivo de estabelecer obrigações ou compromissos com terceiros, nem de promover uma oferta ou solicitação de oferta de venda ou compra de quaisquer valores mobiliários, commodity interests ou produtos de investimento.

A Hedgepoint e suas associadas renunciam expressamente a qualquer uso das informações contidas neste documento que direta ou indiretamente resulte em danos ou prejuízos de qualquer natureza. As informações são obtidas de fontes que acreditamos serem confiáveis, mas não garantimos a atualidade ou precisão dessas informações.

O trading de commodity interests, como futuros, opções e swaps, envolve um risco substancial de perda e pode não ser adequado para todos os investidores. Você deve considerar cuidadosamente se esse tipo de negociação é adequado para você, levando em conta sua situação financeira. O desempenho passado não é necessariamente indicativo de resultados futuros. Os clientes devem confiar em seu próprio julgamento independente e/ou consultores antes de realizar qualquer transação.

A Hedgepoint não fornece consultoria jurídica, tributária ou contábil, sendo de sua responsabilidade buscar essas orientações separadamente.

A Hedgepoint Schweiz AG está organizada, constituída e existente sob as leis da Suíça, é afiliada à ARIF, a Associação Romande des Intermédiaires Financiers, que é uma Organização de Autorregulação autorizada pela FINMA. A Hedgepoint Commodities LLC está organizada, constituída e existente sob as leis dos Estados Unidos, sendo autorizada e regulada pela Commodity Futures Trading Commission (CFTC) e é membro da National Futures Association (NFA), atuando como Introducing Broker e Commodity Trading Advisor. A Hedgepoint Global Markets Limited é regulada pela Dubai Financial Services Authority. O conteúdo é direcionado a Clientes Profissionais e não a Clientes de Varejo. A Hedgepoint Global Markets PTE. Ltd está organizada, constituída e existente sob as leis de Singapura, isenta de obter uma licença de serviços financeiros conforme o Segundo Anexo do Securities and Futures (Licensing and Conduct of Business) Act, pela Monetary Authority of Singapore (MAS). A Hedgepoint Global Markets DTVM Ltda. é autorizada e regulada no Brasil pelo Banco Central do Brasil (BCB) e pela Comissão de Valores Mobiliários (CVM). A Hedgepoint Serviços Ltda. está organizada, constituída e existente sob as leis do Brasil. A Hedgepoint Global Markets S.A. está organizada, constituída e existente sob as leis do Uruguai.

Em caso de dúvidas não resolvidas no primeiro contato com o atendimento ao cliente (client.services@hedgepointglobal.com), entre em contato com o canal de ouvidoria interna (ombudsman@hedgepointglobal.com – global ou ouvidoria@hedgepointglobal.com – apenas Brasil) ou ligue para 0800-8788408 (apenas Brasil).

Integridade, ética e transparência são valores que guiam nossa cultura. Para fortalecer ainda mais nossas práticas, a Hedgepoint possui um canal de denúncias para colaboradores e terceiros via e-mail ethicline@hedgepointglobal.com ou pelo formulário Ethic Line – Hedgepoint Global Markets.

Nota de segurança: Todos os contatos com clientes e parceiros são realizados exclusivamente por meio do nosso domínio @hedgepointglobal.com. Não aceite informações, boletos, extratos ou solicitações de outros domínios e preste atenção especial a variações em letras ou grafias, pois podem indicar uma situação fraudulenta.

“Hedgepoint” e o logotipo “Hedgepoint” são marcas de uso exclusivo da Hedgepoint e/ou de suas afiliadas. O uso ou reprodução é proibido, a menos que expressamente autorizado pela HedgePoint.

Além disso, o uso de outras marcas neste documento foi autorizado apenas para fins de identificação. Isso, portanto, não implica quaisquer direitos da HedgePoint sobre essas marcas ou implica endosso, associação ou aprovação pelos proprietários dessas marcas com a Hedgepoint ou suas afiliadas.

aA Hedgepoint Global Markets é correspondente cambial do Ebury Banco de Câmbio, de acordo com a resolução CMN Nº 4.935, DE 29 DE JULHO DE 2021, Artigo 14 do Banco Central do Brasil (BACEN).

Para mais informações sobre nosso parceiro, serviços disponíveis, atendimento e ouvidoria, acesse o link a seguir: https://br.ebury.com/