Whenever there´s a hurricane season in the United States (U.S.), energy markets need to be aware. This severe weather phenomenon can impact infrastructure,

Whenever there´s a hurricane season in the United States (U.S.), energy markets need to be aware. This severe weather phenomenon can impact infrastructure, supply, and prices of energy commodities such as oil, refined products, and natural gas locally and globally due to interruptions in production flows, so we need to keep an eye out.

We invited Victor Arduin, hEDGEpoint Market Intelligence Analyst, to talk about the subject and highlight the role of risk management in this context. According to him, a large part of the U.S. energy infrastructure is located on the coast of the Gulf of Mexico, an important hub for the entire planet which is directly affected by hurricanes.

Victor Arduin, Market Intelligence Analyst

“In the country, approximately 45% of the refining capacity for petroleum products is concentrated in this area, in particular the states of Texas, Louisiana, Mississippi, and Alabama,” Arduin explained.

Keep reading to learn more!

Hurricanes are weather storms that occur near the Equator. They´re formed when water temperatures are higher. Thus, the Atlantic hurricane season runs from June to November, Victor clarified.

“Heading into the Gulf of Mexico, these storms arise due to numerous weather factors. They include atmospheric pressure, wind direction, and water temperature. When they gain intensity, they can go up a scale of 1 to 5.”

Now in 2023, the National Oceanic and Atmospheric Administration (NOAA) has predicted a 40% chance of a near-normal season, with a 30% chance of an above-normal season, and a 30% chance of a less-than-normal season.

In order for you to realize just how the hurricane season can change the entire North American energy sector, let’s look at some practical examples.

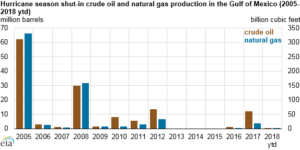

Throughout U.S. history, hurricanes Audrey (1992), Katrina (2005), Ike/Gustav (2008), Harvey (2017), and Ida (2021) all drastically hit the country. Since a large part of its energy production is located in the Gulf of Mexico, the area was heavily damaged by hurricanes.

History of Oil Production in the Gulf of Mexico (since 2000)

Source: EIA (Energy Information Administration)

Hurricane Audrey, for example, was extremely destructive in the Bahamas, Florida, and Louisiana.

“In the U.S. energy market, it was responsible for destroying around 13 offshore platforms, industrial structures installed in deep waters, usually at sea, for the exploration and production of commodities such as oil and natural gas. As a result, around 5% of gas production in the U.S. was affected,” Arduin emphasized.

At times like these, according to Arduin, the prices of energy commodities suffer great volatility. This happens due to market price interruptions in the supplies of oil, gasoline, and diesel.

Hurricane Katrina, on the other hand, presented winds that reached more than 280 km/h and caused enormous damage to the southern coast of the U.S. Its magnitude was so great that it paralyzed almost 90% of oil production on the Gulf Coast.

“The price of gasoline skyrocketed to incredibly high values. At that time, the George W. Bush government needed to release around 30 million barrels of gasoline for public use from its strategic reserves,” pointed out the hEDGEpoint specialist.

Hurricane Ike, in turn, affected around 60 offshore platforms. Arduin went on to explain the main effects.

“In addition, it damaged 31 more rigs in a significant way. Another high-profile hurricane was Harvey, which forced the shutdown of 18 refineries in Texas, damaging 20% of US refining capacity,” he recalled.

The hurricane season interrupted crude oil and natural gas production in the Gulf of Mexico (from 2005 to 2018)

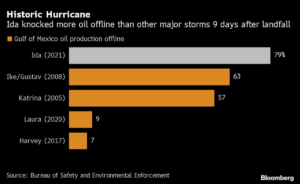

In 2021, Hurricane Ida became the second most intense hurricane to make landfall in the state of Louisiana. As a result, it suspended energy supplies from the Gulf Coast, closing ports that export energy commodities and slashing motor fuel production by nearly half.

Ida left oil drilling operations more crippled than other major storms nine days after the touchdown.

Source: Bloomberg

You may have noticed that hurricanes change the entire energy dynamic in the U.S. But the repercussions are also felt in world energy markets.

The Gulf of Mexico coast region produces around two million barrels of oil per day. Just to give you an idea of this magnitude, the whole of Brazil produces around three million a day, Arduin clarified.

“The U.S. states on the Gulf of Mexico coast are essential for world oil production, corresponding to about 2% of the total global supply, which is around 105 million barrels per day,” Victor continued.

When these storms happen, they cause changes in oil production and supply, and international markets react. With less supply and practically inelastic demand in the world, there´s a considerable increase in prices.

“This situation causes fear in the market. One of the reasons is the very role of the U.S., as it´s an exporter of both oil and refined products. With these storms, there are risks of production interruption, and several countries suffer significant impacts, as they depend on North American products,” commented Arduin.

To exemplify this situation, just think of Brazil. The country imports large volumes of diesel from the U.S., for example. The United States has taken advantage of Latin America’s energy production deficiency as a whole to export refined products and oil.

“The population is growing, as is energy demand. In South America, we haven´t kept up with this growth in supply capacity in relation to the growing demand, which requires importing,” Arduin stated.

The market prepares itself with apprehension, closely following meteorological phenomena. Regarding risk management, Arduin stresses that there are two fundamental points: the risks that can be controlled, and those that cannot.

“In the first case, we can perform hedging operations. Think of a company that imports diesel in Brazil and wants to protect itself from exposure to the risk of sharply rising prices. You don’t know if the price will go up or down in the future. So, you can use derivatives to hedge and reduce your exposure to volatility, thus fixing your margin and guaranteeing your operations,” he explained.

Hence, through financial instruments, it´s possible to have a certain amount of control or predictability regarding the income that can be earned. Regarding the risks we can´t control, imagine a U.S. company located on the Gulf Coast.

“The company may resort to derivatives, but it also depends on its physical production. When that´s paralyzed, there´s nothing they can do. The company is exposed to this risk which cannot be controlled,” he pointed out.

To understand the issue better: think of an oil producer, for example. If the price of a barrel goes up, it’s better for the company. But if the scenario changes: consider an airline that depends on the purchase of aviation kerosene and runs the risk of paying more for the refined product, since a good part of the cost depends on the input that is oil. In this situation, the airline company may use derivatives when purchasing the product.

“If the price goes up, the aviation company will gain in the financial market, even though the physical market is more expensive. Thus, it manages to balance financial and physical gains and losses to obtain their desired margin,” concluded Arduin.

There are different types of risks in energy markets. With ongoing political and economic changes, as well as ongoing wars, and the imminence of climate change, risk management is a feasible option to anticipate the above scenarios.

In such a volatile market, you can reach a professional hedging partner that has extensive knowledge of the energy sector, as is the exact case with hEDGEpoint. We put together the knowledge of our employees in different fields to offer you risk management products for different commodities.

Rua Funchal, 418, 18º andar - Vila Olímpia São Paulo, SP, Brasil

Contato

(00) 99999-8888 example@mail.com

Section

Home

O que Fazemos

Mercado

Quem Somos

HUB

Blog

Esta página foi preparada pela Hedgepoint Schweiz AG e suas afiliadas (“Hedgepoint”) exclusivamente para fins informativos e instrutivos, sem o objetivo de estabelecer obrigações ou compromissos com terceiros, nem de promover uma oferta ou solicitação de oferta de venda ou compra de quaisquer valores mobiliários, commodity interests ou produtos de investimento.

A Hedgepoint e suas associadas renunciam expressamente a qualquer uso das informações contidas neste documento que direta ou indiretamente resulte em danos ou prejuízos de qualquer natureza. As informações são obtidas de fontes que acreditamos serem confiáveis, mas não garantimos a atualidade ou precisão dessas informações.

O trading de commodity interests, como futuros, opções e swaps, envolve um risco substancial de perda e pode não ser adequado para todos os investidores. Você deve considerar cuidadosamente se esse tipo de negociação é adequado para você, levando em conta sua situação financeira. O desempenho passado não é necessariamente indicativo de resultados futuros. Os clientes devem confiar em seu próprio julgamento independente e/ou consultores antes de realizar qualquer transação.

A Hedgepoint não fornece consultoria jurídica, tributária ou contábil, sendo de sua responsabilidade buscar essas orientações separadamente.

A Hedgepoint Schweiz AG está organizada, constituída e existente sob as leis da Suíça, é afiliada à ARIF, a Associação Romande des Intermédiaires Financiers, que é uma Organização de Autorregulação autorizada pela FINMA. A Hedgepoint Commodities LLC está organizada, constituída e existente sob as leis dos Estados Unidos, sendo autorizada e regulada pela Commodity Futures Trading Commission (CFTC) e é membro da National Futures Association (NFA), atuando como Introducing Broker e Commodity Trading Advisor. A Hedgepoint Global Markets Limited é regulada pela Dubai Financial Services Authority. O conteúdo é direcionado a Clientes Profissionais e não a Clientes de Varejo. A Hedgepoint Global Markets PTE. Ltd está organizada, constituída e existente sob as leis de Singapura, isenta de obter uma licença de serviços financeiros conforme o Segundo Anexo do Securities and Futures (Licensing and Conduct of Business) Act, pela Monetary Authority of Singapore (MAS). A Hedgepoint Global Markets DTVM Ltda. é autorizada e regulada no Brasil pelo Banco Central do Brasil (BCB) e pela Comissão de Valores Mobiliários (CVM). A Hedgepoint Serviços Ltda. está organizada, constituída e existente sob as leis do Brasil. A Hedgepoint Global Markets S.A. está organizada, constituída e existente sob as leis do Uruguai.

Em caso de dúvidas não resolvidas no primeiro contato com o atendimento ao cliente (client.services@hedgepointglobal.com), entre em contato com o canal de ouvidoria interna (ombudsman@hedgepointglobal.com – global ou ouvidoria@hedgepointglobal.com – apenas Brasil) ou ligue para 0800-8788408 (apenas Brasil).

Integridade, ética e transparência são valores que guiam nossa cultura. Para fortalecer ainda mais nossas práticas, a Hedgepoint possui um canal de denúncias para colaboradores e terceiros via e-mail ethicline@hedgepointglobal.com ou pelo formulário Ethic Line – Hedgepoint Global Markets.

Nota de segurança: Todos os contatos com clientes e parceiros são realizados exclusivamente por meio do nosso domínio @hedgepointglobal.com. Não aceite informações, boletos, extratos ou solicitações de outros domínios e preste atenção especial a variações em letras ou grafias, pois podem indicar uma situação fraudulenta.

“Hedgepoint” e o logotipo “Hedgepoint” são marcas de uso exclusivo da Hedgepoint e/ou de suas afiliadas. O uso ou reprodução é proibido, a menos que expressamente autorizado pela HedgePoint.

Além disso, o uso de outras marcas neste documento foi autorizado apenas para fins de identificação. Isso, portanto, não implica quaisquer direitos da HedgePoint sobre essas marcas ou implica endosso, associação ou aprovação pelos proprietários dessas marcas com a Hedgepoint ou suas afiliadas.

aA Hedgepoint Global Markets é correspondente cambial do Ebury Banco de Câmbio, de acordo com a resolução CMN Nº 4.935, DE 29 DE JULHO DE 2021, Artigo 14 do Banco Central do Brasil (BACEN).

Para mais informações sobre nosso parceiro, serviços disponíveis, atendimento e ouvidoria, acesse o link a seguir: https://br.ebury.com/