Super Wednesday brings information about interest rates in the United States and Brazil

On the last Wednesday, September 20th, one of the most anticipated announcements by the financial market took place. The Federal Reserve, the American central bank, chose to keep the interest rates within the range of 5.25% to 5.50%, as expected.

However, the main focus was on the speech by the Fed’s president, Jerome Powell, who offered valuable clues about the committee’s outlook on inflation and the trajectory of the country’s interest rates. In addition to reaffirming a hawkish stance that was already being adopted, Powell highlighted the robust conditions of the American economy and the resilience of the labor market, factors that justify maintaining additional pressure on financial conditions.

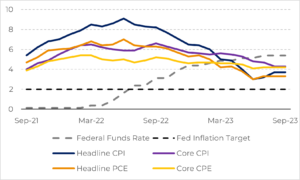

Despite the improvement in core inflation, which excludes volatile components like food and energy, total inflation worsened slightly. This scenario was strongly influenced by energy costs, which saw a substantial increase in the second half. This increase is largely linked to the measures taken by OPEC+ to restrict oil supply.

Chart #1: US Inflation Scenario (%)

Source: Federal Reserve, Bureau of Labor Statistics

Despite the better inflationary scenario, the fight against rising prices is far from over, and there could be a setback in what has been achieved so far if expectations become unhinged. Therefore, according to the “dot plot,” a graph that reflects the inflation expectations of each Fed member, the likelihood of a 25 basis point increase in interest rates by the end of the year is probable.

Some effects of maintaining interest rates in the US are already being felt in the economy. Government bond yields have risen, with the 2-year treasury reaching the highest level in 17 years, close to 5.2%.

Chart #2: U.S. Treasuries Bond Yield

Source: Refnitiv

An even more restrictive stance could have substantial impacts on the market, weighing on risk assets and commodities, which historically are affected by a strong dollar and reduced demand due to high-interest rates. Moreover, high-interest rates maintained for long periods increase the risk of recession for the country, something that would have a profoundly negative impact on the commodities market.

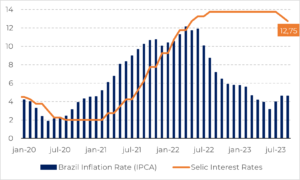

In Brazil, where the monetary cycle is more advanced, as the process of reducing interest rates has been initiated, the Monetary Policy Committee of the Central Bank cut interest rates by 50 basis points during its last meeting, bringing the Selic rate to 12.75%.

This decision was not surprising, as a significant portion of the market already expected this same pace of cuts, as seen in the previous meeting. However, the committee reinforced the intention to maintain this pace until the end of the year. In the words of the statement: ‘… the committee members unanimously anticipate reductions of the same magnitude in the upcoming meetings.

Chart #3: Comparison of Inflation Rate and Interest Rate in Brazil (%)

Source: IBGE, Bacen

This reflects the cautious stance of the Central Bank of Brazil, especially after the United States signaled a possible extension in the period of maintaining low-interest rates, reducing the premium that Brazilian interest rates offer compared to those of the United States. Given that Brazil is an emerging country with a lower degree of investment, it is necessary to offer a broader interest rate differential to attract investments. Consequently, our monetary cycle is influenced by the trajectory of interest rates in the US.

On one hand, the current situation provides room for a reduction in interest rates, with more controlled prices and surpluses in the trade balance. However, there are long-term considerations that limit the continuation of the decline in rates, especially to a greater extent.

Fiscal policy is intrinsically related to the pace of interest rate reduction in the country. Meeting the primary surplus targets set by the government and improving the debt-to-GDP ratio is essential to sustain the decline in interest rates in the country. The minutes to be released next Tuesday, the 26th, will provide more information about the Central Bank’s perspective on inflation and guidance on the trajectory of interest rates in Brazil.