US Elections and the Energy Market: What are the Candidates' Proposals?

Understand what to expect from each candidate in the US elections for the energy market. With Daniel Osorio, Head of Desk – Energy US / LATAM.

The future of the energy market is one of the main issues addressed by the candidates for the presidency of the United States. Both candidates share the common goal of reducing energy costs in the country and increasing jobs in the sector, but they differ in their plans to achieve these goals.

Expert Daniel Osorio, Head of the Energy Desk at Hedgepoint Global Markets US/LATAM, was invited to explain the main energy policies of each candidate and what we can expect for the market if they are elected. Enjoy the read!

Also read:

- The Impact of the US Elections on the Global Economy

What can we expect from Donald Trump for the energy market?

During his previous term (2017-2021), Donald Trump implemented domestic policies that boosted the production of fossil fuels in the United States. The Hedgepoint expert sees a similar scenario for the future if Trump is elected.

-

Cost-cutting policies

“Trump is in favor of energy independence for the United States, promoting exploration and production, especially through fracking,” Osorio points out.

For the Republican candidate, the exploration of fossil fuels and the close relationship with energy companies were factors that consolidated the United States as a major net energy exporter. Trump also believes that the sustainable energy policies defined by the Biden-Harris administration played an important role in the increase in fuel prices.

“Donald Trump’s political profile suggests that he should relax these regulations to boost production and provide cheaper fuel to the population. To do this, the Republican may allow oil exploration on protected federal lands, such as parts of Alaska and the Rocky Mountains,” Daniel adds.

-

International and geopolitical position

A second Trump term is expected to be tougher on regimes such as Iran, Russia and Venezuela. Under the Biden administration, sanctions were eased to prevent an increase in energy prices. However, Donald is likely to change this position.

The expert adds: “With Trump, there is a greater likelihood of an aggressive stance against these countries, while Harris would probably maintain a less severe approach.” However, this type of policy could affect fuel prices worldwide, as some producing countries have been involved in the main geopolitical conflicts of recent years.

As for the United States’ delicate relationship with China, Trump intends to put pressure on the Chinese economy with tariffs, which could reduce the Asian country’s demand for energy, in addition to affecting the global energy market.

Also read:

- World Oil Day: prospects for the future of the market

How would Kamala Harris manage the energy market?

Unlike Trump, the Democratic candidate has a pro-renewable energy policy profile. During the Biden administration, the current Vice President supported the creation of policies and regulations that prioritized the production of green energy. If elected, the candidate should continue in the same direction, investing primarily in biofuels and other renewables.

“Kamala Harris recognizes the need for stricter environmental regulations and incentives for clean energy technologies such as solar and wind,” Osorio says.

The Hedgepoint expert points out that the Democrat used to oppose fracking. However, Harris has backed away from banning the practice precisely because she wants to lower prices.

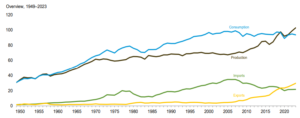

The candidate has shown some flexibility on oil production in the United States, as she did during the Biden-Harris administration. According to the IEA (U.S. Energy Information Administration), it was during the current administration that the North American country reached a historic record in fossil fuel production.

See below:

Source: IEA

-

International Positioning

Candidate Kamala Harris offers a different position than Trump on global geopolitical conflicts. Daniel Osorio reports that the Democrat has maintained a more lenient administration alongside Biden over the past four years, and that this should continue if she is elected.

“If Kamala wins the election, expect a more moderate stance on Iran, Russia and other countries involved in geopolitical conflicts. The current vice president is maintaining this relationship with these nations so as not to affect global fuel prices,” Osorio concludes.

As for relations with China, the expert also expects little change from the current administration. “Kamala tends to keep the agreements as they are, without antagonizing China, for example.”

Also read:

- The development of the bioenergy market in the world

The elections in the United States and the volatility of the energy market

Prices in the commodity market are influenced by several factors, such as supply, demand and politics. U.S. elections usually put some pressure on the prices of commodities, including fuels.

According to Daniel Osorio, “Energy prices and market volatility are likely to increase both before and after the U.S. elections. In recent presidential elections, commodity prices have been hit by uncertainty about the outcome, and this year the data shows increasingly close polls.

“Immediately after the election, we can expect high volatility in the energy market until the political positions are clear. This period may last about six months until both sides define their policies for the economy and the energy sector.”

In this scenario, the use of hedging is essential to protect commodity companies from price volatility. With advanced tools, fuel companies can operate with greater financial security until the outcome is known.

Contact Hedgepoint and count on professionals specialized in the energy market.

Also read:

- Hedging courses available at Hedgepoint HUB