Argentine soybeans: follow the data for the 2023/2024 crop

Current Argentine soybean crop. See data, price expectations and much more.

According to the United States Department of Agriculture (USDA), Argentina is the third largest soybean producing country in the world, with a 13% share of global figures. Among the largest importers of Argentine soybeans are China, Mexico, Japan, Spain and Germany, among others.

This year, the country’s soybean harvest ended (in mid-June) with a significant increase in yield, reaching almost double that of the previous year. In today’s text, we will understand the causes of this growth, as well as examine data on soybean sales, price expectations for 2025 and much more. Good reading!

Argentine soybean production doubles compared to the previous year

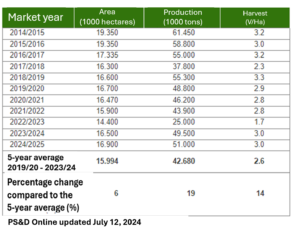

The number of bags of soybeans harvested in Argentina has increased again after a significant drop in the previous year. For the 2022/2023 crop, the country suffered a historic drought in all of its producing regions, which halved its yields. The production volume was the lowest in the last 20 years and barely reached 23 million tons of soybeans. See data released by the Buenos Aires Grain Exchange:

In the previous harvest, high temperatures also affected Argentine crop yields and caused a reduction in planted area. At that time, the government estimated a 3% impact on the country’s GDP and a loss of US$20 billion, adding up the losses of all cereals.

This year, Argentina’s soybean production returned to its previous levels, reaching even better levels with a harvest of 50.5 million tons. Due to favorable weather, planting for 2023/2024 was 24% higher than the average of the last five years.

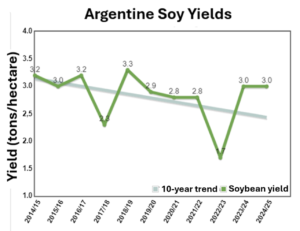

Rainfall and soil moisture also allowed progress to be made in terms of cultivated area, with 96% of the eligible area used. The Buenos Aires Grain Exchange also reported that the average crop yield reached 2.9 tons per hectare, almost double that of the previous year.

See below the report published by the USDA showing this oscillation in the last two years of Argentine soybean production:

The website has also published figures for Argentina’s latest soybean harvests. Check them out:

With high yields, other figures accompany the good soybean production. The USDA reported that by-product exports have also grown this crop. Argentine soybean meal exports are expected to reach 27 MMT (million metric tons), making the country the largest exporter of this commodity in the world. Soybean oil exports are also expected to grow to 5.3 MMT.

On the economic front, the current Argentine soybean crop is expected to yield a gross value of $17.2 billion, up 104% from the previous year. The estimate for exports is also high at $19.9 billion.

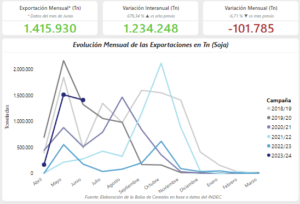

Below, you can see Argentina’s monthly soybean export figures for the past few years and the current crop figures through June:

Source: Buenos Aires Grain Exchange

Read also:

- The role of cooperatives in the development of the Brazilian agricultural market.

The evolution of Argentine soybean sales

With the harvest over, Argentina is marketing its current soybean yield. However, the pace of sales has not reached the usual average for this time of the year. The Federación Intercooperativa Agropecuaria (Coninagro) reported that only 34% of the crop had been sold as of mid-May, down 4% from the five-year average for this period.

In tons, sales are already higher than in previous years, but the proportion is still lower. Between May and June, the drop was even greater: 45% from one month to the next. You can follow the data directly on the Grain Exchange website.

One of the reasons for the drop in sales may be the difference between official and informal prices of the Argentine currency (peso) in the exchange market. With a larger gap between these values, exchange rates end up pressuring exchange prices and slowing down sales.

Read also:

- Foreign exchange: a journey to global investments.

Expectations for soybean prices in 2025

In the commodities market, supply and demand are the main factors influencing commodity prices. High soybean production in Argentina, for example, increases the supply of the grain and consequently changes its value in commodity indices.

By 2025, soybean prices are likely to fall precisely for this reason. Crop forecasts for the three largest producers (United States, Brazil and Argentina) indicate positive yields. La Niña weather conditions could favor increased production and the world crop forecast is 421.85 million tons.

Hedging tools for risk management

With a possible increase in supply, farmers and market traders expect a reduction in prices. In this scenario, many are looking for hedging tools to manage financial risks.

At Hedgepoint we work with over 450 hedging products designed to protect your business from price fluctuations in the commodity market. Get in touch and talk to a specialist to find the right tool for you.