Grain storage in Brazil: Understand the problem

Marcelo Lacerda, hEDGEpoint’s Head of Desk – Sales – Brazil Grains/Cotton, explains the grain storage problem in Brazil, and how risk management can help producers.

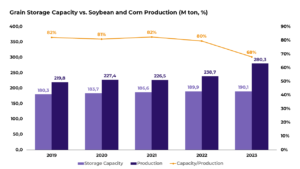

The insufficient grain storage capacity in Brazil has been underscored by the 22/23 harvest. The current estimate, according to the 9th survey by Conab (Companhia Nacional de Abastecimento), is that grain production will reach 315.8 million tons, an increase of 15.8%, or 43.2 million tons more than the previous season.

Soy shows the most growth, totaling a volume of around 155.7 million tons, followed by corn, with 125.7 million tons. Together, these two commodities represent 72.5% of the total grains in the 22/23 harvest. In this scenario, storage has become even more challenging. According to Marcelo Lacerda, Head of Desk – Sales – Brazil Grains/Cotton at hEDGEpoint, the challenge lies in the fact that production is significantly greater than the available storage space, with the risk of having a deficit of almost 124.9 million tons:

“Today, the country produces more than it can effectively store. Our storage capacity is around 180 to 190 million tons, much lower than the projections indicate in relation to total production,” Lacerda explains.

In this article, you’ll begin to understand why grain storage is a problem that needs to be faced by the Brazilian nation, and how risk management can help producers.

Static capacity lower than production

Static capacity refers to the availability of grain storage structures. In Brazil, this capacity is considerably lower than the amount of grain produced. For this reason, many producers have deposited part of their harvest using alternative methods such as silo bags, which are compartments that allow storing all types of grains and silage: “It’s a palliative measure, which is also riskier and can lead to production loss,” Lacerda continues.

Analyzing the evolution of storage capacity based on Conab data, an average growth rate of just 2.3% per year over a 10-year period is evident. In the same period, the increase in corn and soybean production was 5.6% per year. This is a worrying scenario, since the storage deficit reduces the producer’s power to choose the optimal selling point, putting more pressure on prices:

“The producer may be forced to sell soybeans or corn, if production is greater than storage capacity, considering harvest and off-season, even if prices are not attractive. This puts pressure on the market to sell, and lowers producers’ prices even more,” clarifies Lacerda.

Grain Storage Capacity vs. Soybean and Corn Production (M ton, %):

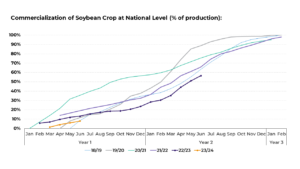

The 22/23 soybean crop yielded a very large harvest, and sales negotiations are still underway. According to hEDGEpoint analysis, there’s still an estimate of almost 40% of the 22/23 soybean crop to be sold. With the start of the corn harvest, the competition for space with soybeans intensifies the battle for storage capacity, impacting sales.

Commercialization of Soybean Crop at National Level (% of production):

The soybean market has greater liquidity compared to corn. In practice, it means that it’s easier to redeem the amounts invested in this commodity, because it can be sold at better prices. Lacerda points out that this makes some producers choose to store soybeans while selling corn:

“The risk is the reduction of North American exports, since Brazil will be selling a lot of corn on the foreign market, affecting quotations on the Chicago Stock Exchange,” he clarified.

Losses could total up to R$ 30.5 billion in 2023

With record harvests along with the high grain storage deficit, export premiums for soybeans and corn are at negative levels in relation to the international market. The premium is a value that can be positive or negative, representing a premium or a discount compared to international price benchmarks. It reflects the value that the importer is willing to pay for the commodity, determined through negotiations between exporters and importers, using the Chicago Stock Exchange value as a reference.

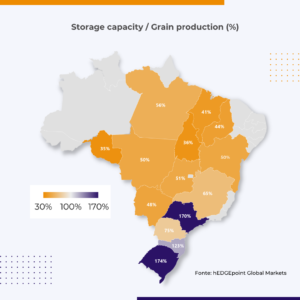

Another important point is the difference in storage capacity between different states. Rio Grande do Sul, Paraná, and São Paulo are examples of those with greater storage space, while Mato Grosso, the main grain producer in the country, has a deficit of 50%–that is, only half of what’s produced there can be stored.

Grain Storage Capacity vs. Soybean and Corn Production by State (%):

We conclude that Brazil does not have enough structure to store its annual production of grain harvests. Also, some states lack space while others have a surplus. In this sense, it’s essential for the country to adopt better distribution logistics, while encouraging the adoption of policies that will increase static storage capacity.

With these measures, the producer will be able to sell at more favorable moments, with greater control over the prices of exported products. Risk management also plays an important role here, providing even more security, as explained below.

How can risk management help the producers?

Several factors constantly contribute to the volatility of commodity markets. Uncertainties due to political and economic contexts at local and global levels, and the storage capacity itself can affect supply and demand. Specialist Marcelo Lacerda warns us about one of the main functions of risk management related to storage:

“The producer is able to sell the product and set up derivative strategies that allows them to participate in an eventual increase. They can sell their soybeans on the physical market, for example, and form a protective structure against the rise, through derivatives. This is a risk management solution regarding the storage issue,” Lacerda elucidates.

In this way, risk management plays a vital role. hEDGEpoint offers hedging products that allow producers to guarantee a minimum selling price, so they can participate in market increases through option structures. In addition, we provide valuable analysis and technology that unite specialist knowledge to make better, more strategic decisions with each business model.

Talk to a hEDGEpoint expert today to learn more!