India's role in the palm oil market

Understand what role India plays in the global palm oil market, see the country’s import data, development policies and more.

Palm oil is the most widely consumed vegetable oil in the world. It is used in foods like chocolate and margarine, and in cosmetics like soaps, shampoos and detergents. In 2022/23, global consumption of palm oil reached about 78 million metric tons.

One of the reasons for its high consumption and popularity as a feedstock is its high yield. Oil palm trees produce more oil per hectare than any other oilseed crop (about 45-55%). Despite its low cost, palm oil is of excellent quality compared to other commodities in the same class.

India is the largest importer of palm oil in the world, and its influence on global prices is significant, as is its potential as a producer. In this article, we’ll look at India’s role in the market, data on the country’s consumption and imports, and more.

We spoke with Vipul Bhandari, Head of Desk at Hedgepoint EMEA, to gain insight into the key challenges facing the industry. Bhandari points out that India’s consumption of palm oil is so significant that it has a direct impact on the economies of Indonesia and Malaysia, which depend on exports to India.

He also points out that palm oil is used in a wide range of products and feeds a population of 1.4 billion people, about 20% of the world’s population.

Enjoy reading!

India’s relationship with palm oil

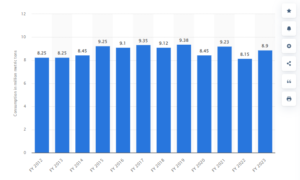

India is the second largest consumer of palm oil in the world, after Indonesia (which is also the world’s leading producer). The country has a high demand for domestic consumption of the product, reaching an average of 9-10 million tons consumed per year over the last decade.

Palm oil consumption in India between 2012 and 2023:

Source: Statista

However, according to the USDA, India is only the 13th largest producer in the world. The agency claims that India will only reach 0.4% of the world’s total palm oil production in 2023, with 305,000 metric tons.

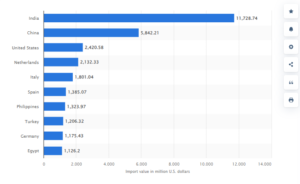

Due to high domestic demand, India has become the world’s largest importer of palm oil. The country uses the product in a variety of ways, including edible oil, cosmetics and biofuel. In 2022, the Asian country imported more than twice as much as China, which was the world’s second-largest importer. “The impact of India’s palm oil consumption extends beyond its borders, playing a critical role in the economic stability of major exporting countries such as Indonesia and Malaysia,” Bhandari said.

See the data below:

Source: Statista

Indonesia and Malaysia are the two main suppliers of palm oil to India, followed by Thailand, Singapore and Papua New Guinea. In June 2024, imports of the product increased even more due to strong demand from refineries for the upcoming Indian festivals. According to Forbes, there was a 3% increase in imports in June compared to the previous month. This was the highest level in the last 6 months.

“The volatility of palm oil prices in the global market is directly linked to fluctuations in production and exports in key countries such as Indonesia and Malaysia, as well as the import policies of major consumers such as India,” adds Bhandari.

Read also:

- Challenges for India’s sugar and ethanol industries after elections+i9o

India to boost domestic palm oil production

India’s high dependence on imports has led the country to seek greater self-sufficiency in palm oil production. One of the strongest initiatives launched by the Indian government is the National Mission for Edible Oils (NMEO). The program aims to increase the area under palm oil cultivation in the country and strengthen the domestic economy.

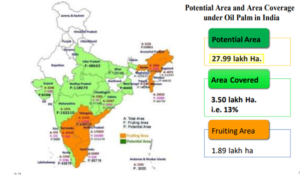

According to the NMEO website, only 370,000 hectares of palm oil are grown in India. However, the national government estimates that 2.8 million hectares can be cultivated in the country.

The goal of expanding palm oil plantations in India is to reach 1 million hectares by 2025, in addition to increasing production to 1.12 million tons in the same period.

See the map released by the program of the areas that can still be used for palm oil plantations:

Source: NMEO

In addition, agreements between India and Malaysia aim to increase bilateral cooperation in palm oil cultivation. Malaysia supplies 3 million tons of the product to India each year. The two countries aim to strengthen ties to share knowledge in production, research, and strengthen agreements.

India is the world’s largest buyer of palm oil, so any change in policy will have an immediate impact on palm oil prices. “India’s edible oil stocks are under pressure despite high import volumes. This is due to the country’s voracious domestic demand as middle class incomes rise and refining margins remain attractive. Any policy adjustments to limit edible oil inflows could lead to an increase in edible oil prices in the country, raising the prospect of higher inflation, while increasing potential stocks in Malaysia and Indonesia, which will lower prices,” he points out.

India will remain a major player in edible oil imports for a long time to come, so any talk of changes in edible oil policy, especially around the time of the federal budget in February, is likely to cause volatility in prices.

Read also:

- Argentine soybeans: follow the data for the 2023/2024 harvest

Rising palm oil imports in India and their economic impact

As the largest importer of palm oil in the world, India influences the prices of this product. For example, the recent increase in imports has increased global demand and affected international prices. Exporting countries such as Indonesia and Malaysia also come under pressure in such situations and have to adjust their production and values to meet the growing demand driven by India.

According to The Economic Times, Malaysia has been trading palm oil near its highest levels in recent months. These price fluctuations don’t just affect India: several importing countries may also feel the increase in value. “The decline in exports from Malaysia combined with the increase in production is putting pressure on palm oil prices, especially against the backdrop of high stocks. This pressure is expected to continue to influence the global market in the short and long term,” says Bhandari.

In addition, a more competitive market can have an impact on other competing products. In June, for example, soybean oil imports fell by 16% (to 273,000 metric tons), with the increase in palm oil imports one of the contributing factors.

On the other hand, the Indian government also has tools to control product prices, at least temporarily. In such cases, it is possible to reduce import duties on palm oil to offset market values (as has already happened with refined soybean and sunflower oils in India).

How does hedging help protect against financial risk?

Hedging products are financial instruments that protect companies against price volatility in the commodity market. One example is the volatility in the value of palm oil due to increased imports from India.

In practice, Indian companies that buy palm oil can use products such as futures and options contracts to guarantee fixed prices or a maximum value for their purchases in the near future. This helps protect these companies from unexpected swings in palm oil prices while increasing the predictability of the market.

At Hedgepoint, we have 150 hedging products to meet the needs of any global commodity company. Contact an expert to learn more about our tools.

Also read:

- Futures Contract: How Does It Work in the Grains and Oilseeds Market?