The Evolution of the Bioenergy Market in the World

Hedgepoint experts talk about the global bioenergy market and its challenges and expectations for the future.

The bioenergy industry is powered by various types of organic matter, known as biomass. Its energy can come from burning agricultural products, wood, garbage and other waste. These materials are used to produce fuels such as bioethanol, biodiesel, biogas and more.

Brazil and the United States are the largest producers of biofuels in the world. However, according to the International Energy Agency (IEA), the greatest growth in demand for bioenergy will occur in emerging countries such as Brazil, India and Indonesia.

Biofuel demand growth by fuel and region – 2022-2024

Source: IEA

The bioenergy market has grown in recent years due to its sustainability. The IEA states that bioenergy already represents more than 6% of the global energy supply and is set to grow even more in the coming years.

With this imminent evolution, the Hedgepoint team discussed the main information about this market and its expectations and challenges for the future. See the names of the professionals:

- Lívea Coda, Market Intelligence Coordinator.

- Carlos Murilo Barros de Mello, Head of Sugar and Ethanol Americas.

The current global bioenergy scenario

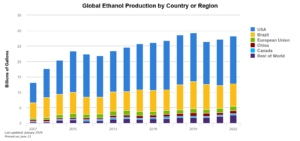

According to Lívea Coda, sugar cane is the world’s main raw material for bioenergy production because it has a high sugar content. In the last decade, corn has also been heavily used for fuel production, especially ethanol.

Source: Renewable Fuels Association

Together, the United States and Brazil produce 80% of the world’s ethanol. Most US ethanol is produced from corn, while Brazil mainly uses sugar cane.

Globally, bioenergy is on the rise because it has contributed greatly to the sustainable goals of various countries, such as the United Nations’ SDG7. Here are some of the investments made around the world according to the IEA:

- Brazil

The investment of resources in the bioenergy sector began in 1975 with Proálcool. The program was created to intensify ethanol production and reduce fuel prices. In 1993, the country also set the percentage of ethanol mixed with gasoline at 22%, today it stands at 27.5% and last year the government presented projects to raise the ceiling to 30%.

“Today, Brazil continues to be one of the largest producers of biofuels with an energy matrix that is one of the cleanest in the world – approximately 85% is renewable, combining the use of hydroelectric, wind and solar energy,” says Mello.

- European Union

The IEA reports that Europe has set itself the target of achieving annual production of 35 bcm (billion cubic meters) of biomethane by 2030, compared to the 3.5 bcm it produces today.

- United States

Major new funding provides resources for various stages of the bioenergy value chain, including encouraging the production of Sustainable Aviation Fuels (SAF), chemicals and biomaterials.

- India

India has extended its Biomass Program to support the production and use of biogas until 2026, and is already producing sugarcane ethanol and has a target of blending 20% into gasoline by 2025.

Read also:

- El Niño phenomenon in Brazil: understand the main effects on the commodities market

The role of the bioenergy market in the economy

In Brazil and around the world, the energy transition may require fiscal and political transfers to mitigate the losses of those who depend on fossils. It is important that the new energy market is flexible, incorporating innovations and adjusting to old models.

The energy sector is directly linked to the energy transition, with new investments such as Sustainable Aviation Fuel. Aviation is facing pressure to reduce its carbon footprint due to awareness of climate change and the effects of greenhouse gas emissions. SAF is a viable option for reducing CO2 emissions, the sector’s main greenhouse gas, offering significant environmental benefits.

Fonte: Secondary Research, Primary Research, MRFR Database and Analyst Review

Hedgepoint’s Market Intelligence Coordinator says: “Sugarcane is the main component in the production of SAF, a fuel that can reduce CO2 emissions by 70% and even 90% compared to conventional fuel.”

Murilo Mello also says that the ethanol SAF is intended to replace oil in aviation without the need for mechanical adaptation. This new fuel could be a new economic alternative for producers, especially in Brazil, which is one of the biggest names in bioenergy.

Murilo Mello also says that the ethanol SAF is intended to replace oil in aviation without the need for mechanical adaptation. This new fuel could be a new economic alternative for producers, especially in Brazil, which is one of the biggest names in bioenergy.

“This will make it much easier to introduce SAF into aircraft engines. Then the market can also focus on technology to improve and lower costs, as well as adding value to the product that will generate income for an exporting country,” adds Mello.

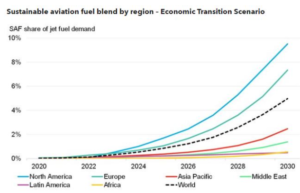

Bloomberg NEF (BNEF) has developed a chart showing data on SAF to date and its prospects for 2030. The forecasts indicate intense growth in the use of this type of bioenergy fuel, especially in Europe and North America. See more:

Source: BNEF

In numerical terms, the BNEF also estimates a significant evolution:

- 5% share of sustainable aviation fuel in global demand by 2030;

- 6 billion gallons of estimated SAF capacity by 2026;

- $1.50 per gallon benefited from US renewable diesel margins compared to SAF.

Hedgepoint’s Head of Sugar and Ethanol Americas also points out the economic power of bioenergy in generating jobs. Because ethanol is a fuel powered mainly by sugarcane, it requires labor to be produced, whether in the field, in industry or in commerce.

Furthermore, the bioenergy market also has an influence on another current social issue: keeping people in the countryside. With more jobs and income in the countryside, urban overcrowding is also reduced through investment in bioenergy, indirectly contributing to environmental preservation and reducing the problems caused by overcrowding in urban centers.

Read also:

- Brazil’s trade balance: understand the importance of commodities

Challenges and expectations for the future of bioenergy

Coda sees a promising future for bioenergy. “It’s a market that has a lot of opportunity due to the need for sustainable energy,” she says.

However, Lívea explains that there is still a lot to be done in this sector. Both professionals raise obstacles and prospects for the future of bioenergy:

● Supply challenges with by-products

As it is an energy based on agricultural and organic products, supply can suffer from competition between markets that use the same raw material, such as sugar and ethanol (which use sugar cane).

● Direct influence of climate

The supply of the product depends on a good sugar cane or corn crop. Climatic events can influence these crops and impact the stock of raw materials.

● High production costs

For Coda, there is still a need for more investment in bioenergy to reduce production costs. Mello believes that technology is the way to turn bioenergy into economic power, especially with the SAF.

● Long-term perspective

Mello also says that the demand for alternative energy sources should boost the market. As a result, new sugarcane products should gain more visibility, especially the use of ethanol as a marine biofuel and ethanol for aviation.

Read also:

- Market risks: 5 factors to monitor closely

How to manage the risks of the bioenergy market?

The evolution of the bioenergy market turns our attention to the current energy market and intersects with the demands of the commodities market. As the Hedgepoint professionals listed, there are important variables that can impact the price of ethanol and other biofuels.

In this scenario, hedging products are important tools for analyzing market fluctuations, contributing to the management of financial risks that can impact all players in the industry. Contact our experts to find out how we can help you turn risks into opportunities.

Get to know our services and see how they can help your business!