Oil Market Outlook to 2030

See demand and production estimates for the oil market through 2030 according to data published by the International Energy Agency (IEA)

The International Energy Agency (IEA) has published its medium-term oil market projections to 2030. The data includes information on global supply and demand, the regions leading consumption, the economic factors shaping the sector, and the challenges posed by the energy transition.

Read more to explore these dynamics and understand the future of the oil industry.

Global Demand and Production Estimates

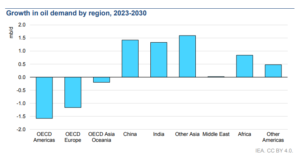

In Oil 2024, the IEA predicts that growth in global oil demand will be driven by emerging economies in Asia, particularly China and India. However, the agency also notes that oil demand in the advanced economies is expected to decline this decade.

In China, fuel consumption is forecast to peak in 2025. Increased sales of electric cars and investment in high-speed rail have slowed the growth of gasoline demand.

In India, transportation fuels will buck the global trend and grow significantly. According to the IEA, demand in the country is expected to increase by 1.3 million barrels per day (mb/d). See estimates for regions of the world in the chart below:

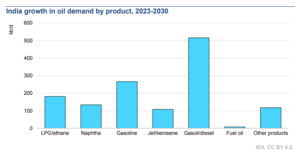

According to the International Energy Agency (IEA), India is on track to overtake China as the largest driver of global oil demand growth by 2030. The country is expected to increase its demand by nearly 1.2 million barrels per day, accounting for more than a third of the 3.2 million barrels per day global increase expected by 2030.

View local demand by product type:

Read also:

- India’s role in driving the palm oil market

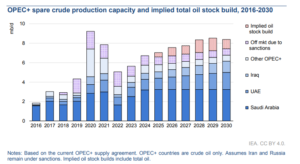

Globally, an increase in global oil production capacity is expected, led by the United States. This expansion will result in a production surplus relative to demand, affecting prices and global reserves.

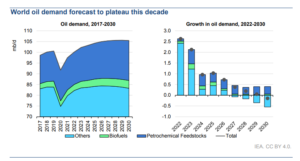

According to the IEA, total oil supply is expected to increase by 6 mb/d to almost 113.8 mb/d by 2030. This figure is 8 mb/d higher than expected global demand (which is 105.4 mb/d). See the projections in the chart below:

Global oil demand is expected to increase in the coming years. However, demand is expected to stabilize by the end of the decade. Demand in non-OECD (Organization for Economic Cooperation and Development) countries is expected to grow by 6.1 mb/d by 2030.

Read also:

- IEA Energy Outlook for Southeast Asia

The impact of prices on the oil market

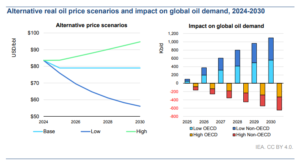

As mentioned by the agency in its document, oil prices are fundamental in forecasting demand. With this in mind, the organization presented demand estimates in two different scenarios: with higher prices and with lower prices.

The higher scenario assumes an increase of 2.5% per year. In this case, global oil demand would decrease by 650 thousand barrels/day in 2030. In the lower price scenario, the values would fall from $79/bbl in 2025 to $69/bbl in 2030. In this case, global oil consumption would increase by 1.1 mb/d by the end of the decade. This data highlights the elasticity of demand in response to economic conditions and energy costs. See this data in the chart:

Read also:

- How does the price of oil affect the agricultural market?

Oil demand in the aviation and maritime markets

In “Oil 2024”, the IEA also addresses specific estimates of oil consumption in aircraft and ships. As reported, these transportation sectors will continue to show growth in fuel demand, albeit at a slower pace due to energy efficiency gains.

In the maritime market, the United Nations Conference on Trade and Development (UNCTAD) forecasts that this sector will grow at an average annual rate of 2.1% until 2028. In aviation, kerosene consumption is expected to exceed pre-pandemic levels by 2027.

Commodity use will expand over the decade

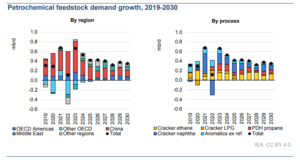

Estimates for the use of oil in derivative products have also been raised by the International Energy Agency. According to the agency, demand for petrochemical feedstocks will be the biggest driver of oil demand growth in the medium term.

Demand in this sector is expected to grow by 2.8 mb/d. This represents about three-quarters of the global increase in oil consumption. In this scenario, China will continue to be the country that moves the most oil, with consumption increasing by 1.3 mb/d between 2023 and 2030. See the chart below:

Read also:

- Real Estate Crisis in China: Impact and Strategies to Mitigate the Effects

This increase in demand is driven by the growth of cities, income growth in emerging markets and the expansion of online shopping and delivery services, which generate the need for packaging. As a result, the IEA expects demand for light olefins (ethylene and propylene) to grow by about 2.8% by 2030.

Access other oil market reports

For more energy market data and information, visit Hedgepoint HUB: a portal with full reports on the world’s most important commodities. Access now!