What is the situation with the 24/25 wheat harvest in Brazil and Argentina?

Find out what the scenario is for the 24/25 wheat harvest in Brazil and Argentina, with an emphasis on what to expect from production in the coming months.

The 24/25 wheat harvest in Brazil and Argentina is extremely important for both countries. After all, they have an important trade relationship: the Argentinians are the main suppliers of wheat to the Brazilians.

There are numerous variables that can affect the wheat market in these two nations. Climatic challenges and Russia’s own supply impact prices and farmers’ decision-making worldwide.

In order to explain the main prospects for the wheat harvest in Brazil and Argentina, we invited professionals from Hedgepoint:

- Sol Arcidiacono, Head of Grains LATAM.

- Andrey Cirolini, Relationship Manager.

- Alef Dias, Market Intelligence Analyst.

Enjoy the reading!

Russian production influences wheat harvest in Brazil and Argentina

To understand the wheat market scenario in Brazil and Argentina, we need to understand the crop situation in Russia. Russia is the largest exporter of this commodity on the planet.

Conditions for the winter cycle in the Northern Hemisphere had been very positive over the last two months. The estimate is for a good export volume, totaling around 50 million tons, with a large supply and an increase in the planted area. However, the climate in the region has been changing and there are concerns about soil moisture:

“It’s started to rain less in Russia, with periods of drought. In general, we still have indications of good supplies for the 24/25 cycle, but there could be a change in the coming weeks and months,” explains Alef Dias.

In the European Union, there were heavy rains in late 2023 and early 2024. The commercial dynamics of countries like Romania and Bulgaria were compromised, as well as a significant reduction in wheat planting in France.

Read more:

Brazil: lower planted area and climate risks

The climate catastrophe in Rio Grande do Sul have left no price reference for Brazilian wheat. As far as the new crop is concerned, there is still time for planting to take place after weather and logistical conditions return to normal.

However, with the end of the El Niño phenomenon in Brazil and the likelihood of La Niña during the winter, production is heading for a time of transition. In this context, the following situation could occur:

“There is a risk of more drought during the period when the crop is established. However, there is less chance of too much rain, especially at harvest time. This is what we saw last year in Rio Grande do Sul,” explains Cirolini.

Another highlight is the reduction in the area planted to wheat in the country. The National Supply Company (Conab) projects an average decrease of 4.7% in the area sown compared to the previous season. The decrease is mainly due to Rio Grande do Sul and Paraná, both of which reduced the area by around 100,000 hectares.

“In 2023, producers in Rio Grande do Sul faced a lot of rain during the harvest, with a loss of both quantity and quality of wheat. With a world scenario of plenty of wheat supply, there was no compensation in prices, resulting in less competitiveness,” says Hedgepoint’s Relationship Manager.

Rio Grande do Sul is currently experiencing its biggest climate tragedy in history. It will be essential to monitor the repercussions of recent events and how they will affect wheat production.

“The normal planting period in the South is in mid-June. That’s why we hope that producers won’t be heavily impacted,” says Cirolini.

Alef Dias also stresses the importance of analyzing how the floods will affect the planted area:

“We’ll need to analyze how the weather conditions in Rio Grande do Sul will affect the planted area. Initially, a smaller planted area was expected, but with better productivity, which generates compensation in total production,” he explains.

Argentina: recovery of soil moisture brings good prospects

Argentina is the main wheat producer in South America. According to Sol Arcidiacono, the recovery of soil moisture and lower fertilizer prices strengthen expectations of a good harvest:

“This is a great start and we’ve also seen a drop in the price of urea, which is used to fertilize wheat. These two aspects are fundamental for calculating the producer’s margin, which defines planting intentions,” she says.

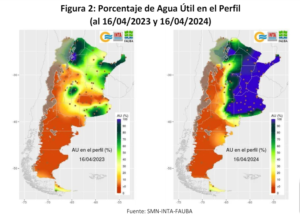

The late activation of El Niño caused abundant rainfall during March and April throughout the country’s agricultural area. As a result, the profile’s reserves are expected to recover dramatically.

Percentage of useful water in the profile

Source: SMN-INTA-FAUBA

Closer to the planting stage, supported also by the good recovery seen on the international prices, Argentina is expecting to see some increase in area, closer to record. The last official number was reviewed to 6,20 M has (Bolsa de Cereales), from the preliminary idea of 5.9 M has, as market and weather conditions have been favoring farmers planting decision.

Changes in the area sown to wheat

Source: Bolsa de Cereais

Argentine producers are preparing to start planting in June. They are then analyzing humidity, global wheat prices and the price of inputs:

““Given the current scenario, we expect a recovery in production of more than 50%, compared to the average of the last two years, reaching around 20 million tons and that would boost export participation, with the need to look for extra destinations apart from Brazil,” said Arcidiacono.

In addition, there is a chance that the area planted to corn will decrease due to the possible effects of La Niña, as they could be more intense on this crop. This is somewhat of an incentive to increase wheat planting and planting soybean during late spring/summer.

In this sense, the weather and economic profitability create a complex panorama for producers to decide whether to plant wheat.

What is the relationship between the Brazilian and Argentinian wheat markets?

The evolution of the Brazilian wheat crop influences Argentine farmers, as they could be at a competitive disadvantage if Brazil’s production is substantially higher. Another factor is the growth of Russian wheat imports into Brazil.

Since Argentina showed a significant drop in its 2023 wheat harvest, Russia has become the second main supplier of the commodity to Brazil, growing participation. If Brazil buys less Argentine wheat, Argentine producers could expand sales to countries like Indonesia, Vietnam and the Philippines. In other words, they will be competing with Russia and other countries in the Black Sea region with historically lower prices:

“For example, in the last two years, Brazil has had a record harvest. So they compensated for Argentina’s lower supply,” explains Hedgepoint’s Head of Grains LATAM.

Read also:

- Wheat market: scenario in Argentina and southern Brazil

The importance of understanding 24/25 wheat crop projections for good price risk management

As you can see, there are various expectations regarding wheat production in the 24/25 harvest. Brazil and Argentina could face new scenarios as La Niña is confirmed.

In addition, macroeconomic factors and the supply of wheat from the Black Sea countries are key aspects in setting prices. Keeping track of all the relevant movements in the wheat market is quite challenging.

That’s why having market intelligence and a team that understands price risk management makes all the difference to your business. Hedgepoint has a team of highly connected professionals with a local presence and global operations. We offer comprehensive data analysis and reporting, together with sophisticated hedging instruments to protect operations from volatility.

Contact our team to learn how we can help you turn risks into opportunities.