A year of rates hikes – Review and Outlook

Our specialists Alef Dias and Heitor Paiva analyzed the causes, the impact on commodities, the weakness of emerging currencies and the banking crisis.

Rate hikes: what caused them?

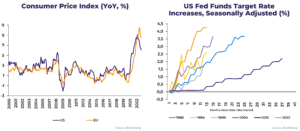

After more than a decade of low inflation, central economies faced a rapid inflation spike since 2021.

Logistical bottlenecks, the war in Ukraine and higher demand due to western economies reopening after Covid are some of the main reasons behind it. That made central banks conduct the fastest monetary hiking of the last 40 Years. Rates are hiked to make credit more expensive, reducing economic activity and consequently the demand for goods – thus, softening the pressure on prices.

Rate hike impact on commodities

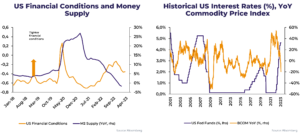

Central banks not only increased interest rates. They also reduced their balance sheets in 2022

Lower liquidity and high interest rates have a negative impact on the prices of raw-materials, given that the resulting weak economic activity demands less commodities. Financial demand for these assets also decrease under these circumstances.

EM currencies weakness and banking crisis

Emerging currencies were hurt by the hiking of developed economies. Banking crisis adds more pain

Rising interest rates in developed economies made emerging currencies weak, as well as impacted banks with questionable risk management policies.

The Fed is now facing a dilemma

Even though inflation levels have substantially cooled, they remain way above Central banks’ targets. Because of that, it could be too soon to end the hiking cycle.

However, keeping rates high can deepen the banking crisis – which can have a huge impact on economic activity and financial stability. At the end of the day, the economic costs from a deep banking crisis seem bigger than those of living the current inflation levels longer. Consequently, the Fed and other central banks could opt to provide more liquidity and reduce their rate’s hiking pace to guarantee financial stability.