Brazil should produce a record grain harvest in the 2023/2024 cycle

Pedro Schicchi, Grains and Oilseeds Analyst at hEDGEpoint, talks about the expectations for a record grain harvest in Brazil in the 2023/2024 season.

The production estimate for the 2023/2024 grain harvest in Brazil is already a historic record. The country is a key protagonist in ensuring food security worldwide, with an emphasis on the production of vital commodities such as soybeans and corn.

These forecasts aren’t surprising: Brazilian agribusiness demonstrates the potential to reach increasingly higher numbers while making investments that improve productivity. But what are the possible consequences of this scenario for the local and global markets?

We invited Pedro Schicchi, Grains and Oilseeds Analyst at hEDGEpoint, to elaborate on the subject. Keep reading to find out!

Brazil: Expectations for record harvest propelled by soybeans

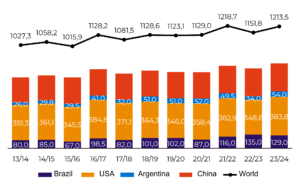

The prospect of record grain production in Brazil for the 23/24 cycle is directly linked to high soybean production. The initial projection from the United States Department of Agriculture (USDA) points to 163 million tons produced on Brazilian soil, an increase of around seven million compared to the previous season.

In the case of soybeans, the USDA indicates there’ll be about 96 million tons exported, a growth of 2.7% compared to the previous cycle. Pedro Schicchi states that global soybean production is highly concentrated in three countries: “Brazil, Argentina, and the United States account for around 80% of world production. If they manage to perform well, there’s a great chance of a record harvest on our planet.”

Expectations of increased production are also related to the forecast for improved productivity in regions such as Rio Grande do Sul, which were considerably affected by droughts resulting from La Niña in the 22/23 harvest. With El Niño underway, Rio Grande do Sul producers usually have favorable conditions. However, the phenomenon tends to be slightly negative for Brazil’s Central-North states.

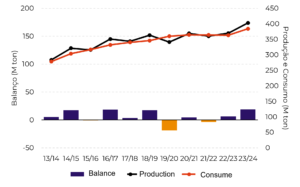

In the graphs below, you can see the evolution of soybean production and global demand, starting with the 13/14 harvest.

Global Soy Production (M tons)

Source: USDA

Global Soy Demand (M tons)

Source: USDA

Corn: An increase in total grain production

Analysis by hEDGEpoint Global Markets estimates the next Brazilian corn harvest to be 133 million tons, slightly below the record of 133.2 million tons in 2022/23, as the harvest enters its final stretch.

Schicchi points out that world corn production is less concentrated than soybean production.

“The three largest producers are the United States, China, and Brazil. Together, they account for an average of 65% of total global production. China has a very relevant weight, with most of the corn destined for domestic consumption,” he explains.

Corn production expectations are less favorable due to specific economic aspects as well as less optimism regarding yields for producers. In terms of exports, the USDA estimates 55 million tons of Brazilian corn will be destined for the international market.

How will the global market respond to this year of record production?

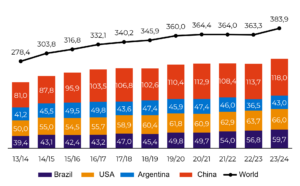

In years of surplus production of grains such as soybeans, prices are generally lower, which helps the consumer while reducing inflation. On top of that, demand hasn´t kept pace with production growth, which affects producer revenues.

“As a result, there could be a drop in prices, as supply will be greater than demand. A lot of soybeans will need to be stored,” Schicchi explained.

Check the global balance of corn and soybean production compared to the rate of consumption below:

Global Corn Balance (M tons)

Source: USDA

Global Soy Balance (M tons)

Source: USDA

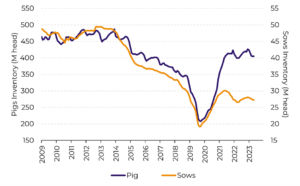

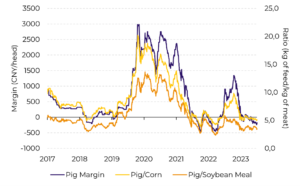

Soy and corn are essential for animal feed and are also the basis for the manufacture of biofuel. Much of the world’s soybeans are used to feed China’s pig herd, for example. However, the Chinese have an excess supply of meat.

“This reduces future growth prospects, as there´s no reason to produce more pigs. Furthermore, despite the population´s tendency to increase—which drives meat consumption—the country’s demand for feed is growing less than global production, which could cause a reduction in the prices of certain commodities, like soybeans and corn, on the foreign market, “ reasons hEDGEpoint´s Grains and Oilseeds Analyst.

In this graph, you can see that due to the slaughter volume, the price of pork is low, while the price of grain remains relatively high, keeping the margin under pressure.

China’s Swine Herd (M heads)

Source: hEDGEpoint, JCI, USDA, Refinitiv

Suínos China – Margens e Razão de Preços em Dalian (CNY/cabeças, kg de ração/kg de carne)

Source: hEDGEpoint, JCI, Refinitiv

The Local Market: 23/24 grain harvest with lower growth in productive area

For the 23/24 grain harvest, producers’ profit margins are tighter, due to the excess supply that hasn´t kept up with the same increase in demand, which has caused lower prices and less purchasing power for the producer.

“Costs are lower, but so are prices. Merchandise prices fell more than those for input. Thus, profit margins are tighter for the 23/24 grain harvest. Given this situation, a lower growth rate for planted areas is expected,” Schicchi clarified.

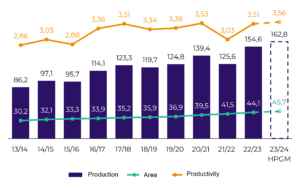

In the graphs below, you can see the hEDGEpoint Global Markets analysis estimates, indicating the areas, yield, and production of soybeans and corn for the 23/24 harvest.

Brazil Soy – Area, Yield, and Production (M ha, Tons/ha, M tons)

Source: Conab, hEDGEpoint

Brazil Corn – Area, Yield, and Production (M ha, Tons/ha, M tons)

Source: Conab, hEDGEpoint

As we can see, there´s the potential for growth in soybean areas, although not as high compared to other years. The productivity index is moderate to favorable. If the Central-West obtains good results, these numbers can be increased. For corn, production levels are expected to be similar to 22/23, with slight growth in terms of area.

What’s the role of risk management in this context?

When producers’ margins are tighter, the role of risk management becomes more critical. Moreover, El Niño’s possible consequences contribute to increasing the chances of better (or worse) results in certain regions.

In this context, market movements can affect profits with greater intensity. Carrying out risk management becomes more essential to protect businesses from volatility. hEDGEpoint offers sophisticated hedging products along with market intelligence and valuable data.

Talk with a hEDGEpoint professional today to learn more.