Five Macro Trends that will move commodity markets up to 2030

Understand the main macro trends that could change commodity market paradigms, with an emphasis on the role of risk management.

Macro trends encompass long-term tendencies that widely affect different spectrums of society, sometimes with economic, political, and cultural impacts. They represent significant and lasting structural changes, with local and global consequences.

These trends are driven by a variety of factors and have effects on commodity markets. Check out the examples here of how macro trends can influence this sector:

- Population Growth and Urbanization: Population growth and rapid urbanization have direct impacts on the supply and demand sides of commodities.

- Technological Advances: Digitalization and artificial intelligence can optimize production and marketing, reducing costs and accelerating processes.

- Sustainability: The search for practices that preserve the environment is driving the demand for commodities with less socio-environmental impacts, which can lead to new requirements in the energy matrix.

- Currency fluctuations, government policies, socio-political conflicts, and trade tensions: these are all macro trends capable of affecting commodity prices, and generating volatility in global chains.

Understanding macro trends is essential to anticipate imminent transformations and adapt to them. With that in mind, we´ve selected the main macro trends for commodity markets and will point out the role of risk management in this context. Continue reading to find out!

Macrotrends: Paradigm shift in the commodities sector

A combination of compelling factors is accelerating a major shift in the commodity paradigm. hEDGEpoint analysis highlights the main macro trends up to 2030. We explain how each of them could truly transform commodity markets in the coming years. Check it out below!

- High-Impact Technologies

According to Digital 2022: Global Overview Report, more than 60% of the planet’s population is connected to the internet, reaching a mark of five billion people. The survey also indicated that almost 23% of global users access social networks in their professional activities. Currently, there are more than 22 billion connected devices globally. According to Statista, that number will rise to 50 billion by 2030.

Given this scenario, 90% of stock trades are already controlled by algorithms. The consequences of this reality are countless for commodity markets. One of them is more production efficiency through automation, with the application of advanced algorithms and data analysis aimed at optimizing operations.

Another transformation is happening in commerce and logistics, with the increased use of mobile devices that facilitate transactions in real time. Automated trading algorithms, artificial intelligence, and machine learning are increasingly employed to predict trends and manage risk. Technology also plays a crucial role in the discovery, exploration, and even extraction of commodities, using drones, satellites, and sensors that identify areas rich in resources.

- Food, climate, and energy security

These are top priorities for most countries. The deglobalization trend was further amplified by COVID-19 and the Ukraine War, two events that disrupted commodity supply chains and spurred inflation. In the medium term, it’s likely that food security difficulties will be reduced as new suppliers are found. Regarding climate and energy, there’s a strong tendency to adopt sustainable practices, which will increase the demand for renewable energies and strategies to minimize greenhouse gas emissions.

- Increased volatility

Since the beginning of the pandemic, we’ve seen a trend towards higher and more volatile prices, especially in energy markets. In Europe, for example, the increase in natural gas prices caused a liquidity crisis in the last 12 months. As new energy sources become available up to 2030, further price stabilization is likely, but we need to stay closely tuned.

With this volatility, commodity producers may suffer a direct impact on their revenues and profits, facing uncertainties related to their sales and input purchases. Investors also run the risk of facing difficulties in planning for the long term, with obstacles even to access credit due to instability. Supply chains and final product prices are likely to be affected if there are changes in supply and demand.

- The ESG Transition

Combining the words Environmental, Social, and Governance, the term ESG is being applied by companies that are preparing plans to reduce or contain adverse environmental impacts. This is yet another important trend for all agents operating in commodity markets.

ESG transitions embody strategies that are part of broader organizational sectors. As a result, practices such as metal recycling, reductions in carbon emissions, and the guarantee of good working conditions in supply chains are being adopted. Governance is also imperative, with strict protocols and proper codes of conduct to ensure full compliance with laws and regulations.

- Demographic Changes

By the end of the century, the world’s population is expected to reach a figure of 11 billion, with exponential growth in Africa and Asia. Life expectancy is increasing, with fewer children expected, especially in Western nations. The changes are also generational, with millennials and those who follow them driving the global economy through new preferences and ways of consuming.

All these aspects will directly affect the supply and demand of commodities, influencing the availability of resources, as well as the axis of influence for businesses linked to commodities, with Asia and Africa assuming a more central role in the markets.

Asia and Africa: Growth and greater demand

hEDGEpoint analysis also highlights population growth in Asia and Africa, which will certainly increase demand for commodities in these regions, especially energy. The Energy Information Administration (EIA) projects an increase of almost 50% in world energy use by 2050, led by the rise of the Asian continent.

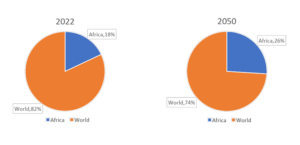

United Nations (UN) data indicates that the population of Africa will grow from 18% in 2022 to 26% by 2050, adding about 1.1 billion people to the world. Take a look at the comparison in the chart below:

Source: United Nations

In Asia, the estimated increase is 628 million people. New centers of urban growth are also emerging on these continents. Currently, 50% of the world’s population live in cities, while they consume ¾ of the world’s natural resources. In this scenario, it will be increasingly important to observe supply and demand dynamics, which could impact commodity markets.

hEDGEpoint: Strategic role in risk management

hEDGEpoint takes all these macro trends into account: We always follow what’s happening in the markets at both a local and global level. In this way, we’re able to outline business strategies that incorporate changes in society and define the best response for our company so we can offer the most appropriate hedging solutions to our customers.

Staying aware of all these trends is essential to devise more effective risk management tools capable of bringing security to your business. hEDGEpoint provides innovative hedging products, delivering valuable insights to clients. We seek to anticipate changes, by mapping trends and contributing to strategic decision-making.

Talk to a hEDGEpoint specialist today to find out more!